European Natural Gas Market - Episode 5

Market Bifurcation & Other Observations

Quick Christmas update on the market after quite some traveling in December…

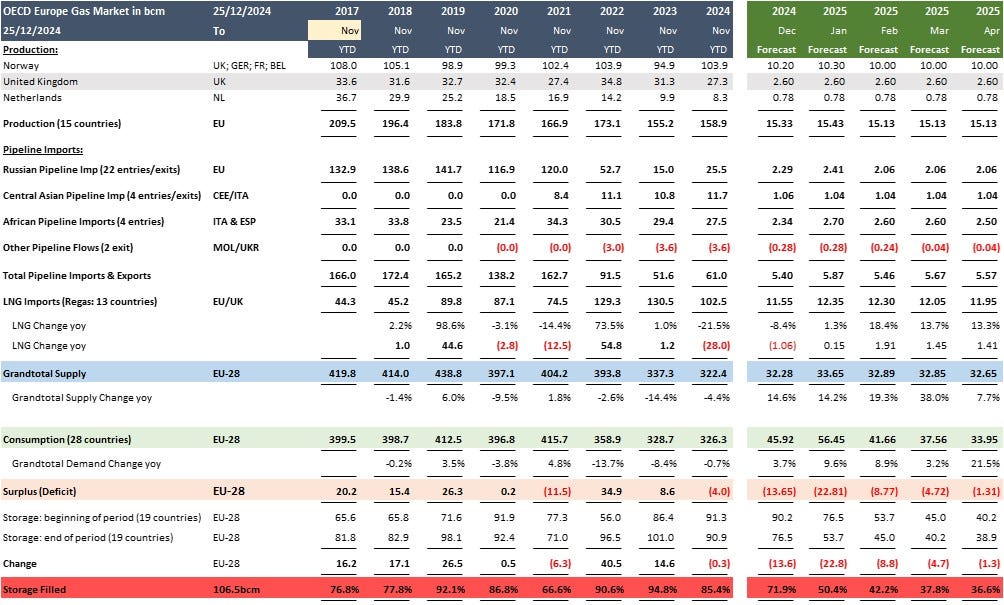

Balances

Our exit storage level for March 2025 remains largely unchanged and stands at 36.6% versus 36.0% in our episode 4 update. If this occurs, it would remain a bull market. We will all find out with the upcoming January weather updates.

Consumption has reduced by 5 bcm since our last update - which is a lot - but our overall supply has also decreased by 1.6 bcm due to disappoint LNG imports.

We now forecast storage draws of 13.65 bcm for the month of December, versus 16.91 bcm in our prior update.

Note that our temperature forecast for January is now based solely on the ECMWF two-month weather forecast model and has thus improved in accuracy. For more information about our methodology, please refer to this episode.

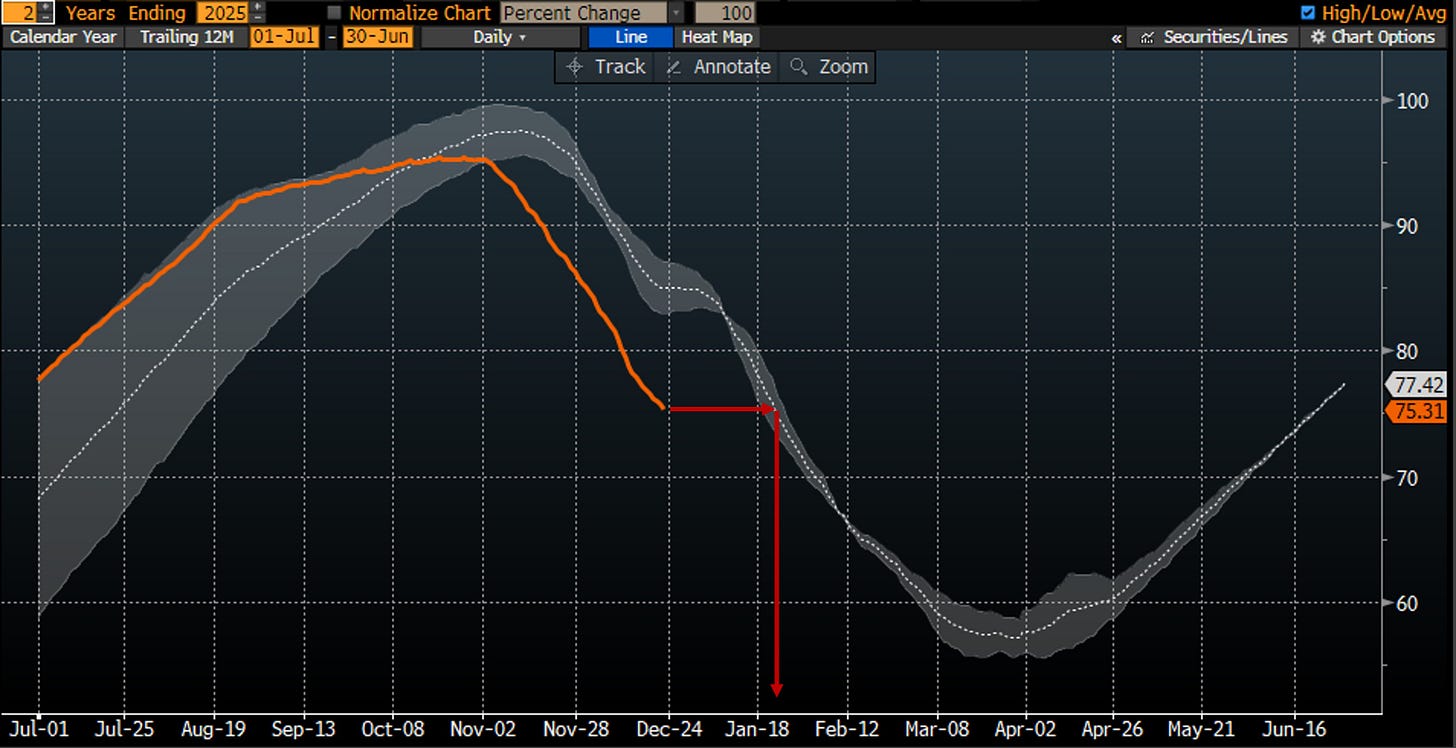

Storages Bifurcation:

The European natural gas market shows sign of bifurcation which does not yet receive any attention in media. But it may matter for overall prices and certainly for price differentials within the EU natural gas market.

What do we mean? As of 24 December 2024, EU storages are now 75.3 % filled. They are thus exactly one month ahead in overall draws versus last season, when they reached this same level on 23 January 2024. That is basically why this is and remains a bull market for now.