The Calm Before the Thaw: Europe’s Natural Gas Market Finds Its Balance

Winter is Coming

High time for an update on my beloved natural gas sector.

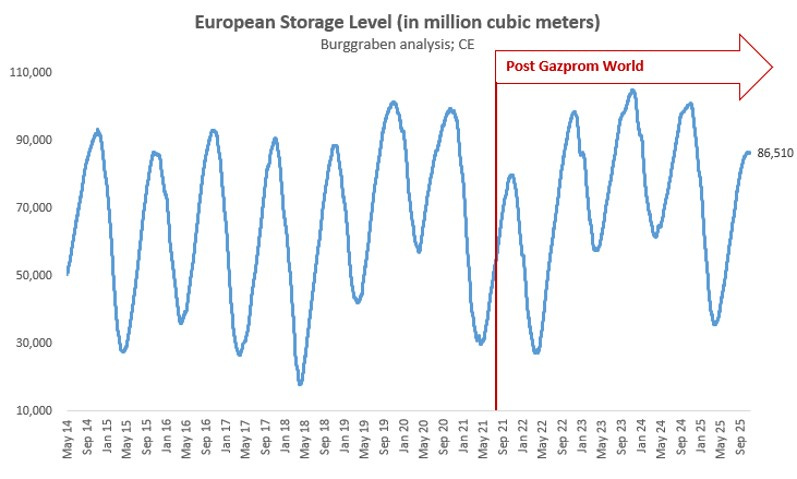

What should have caught your attention is the relatively muted price action in TTF and JKM as Europe enters the winter with storage levels around 82%. To be precise, Europe begins the heating season with 86.5 billion cubic meters (bcm) of natural gas held across 19 countries that provide storage for 28 European nations — our relevant perimeter for TTF price formation, including the UK, Switzerland and Norway, but excluding Ukraine and Turkey.

That is a low level in the post-Gazprom era. In fact, it’s the lowest since the post-Covid winter of 2021/22, when Gazprom, already preparing for its illegal invasion of Ukraine, stopped filling its European storages in Germany and Austria. That same winter, Europe entered with just 78.7bcm in storage. By 2022, Gazprom — at the Kremlin’s order — had shut off nearly all pipeline supplies to Europe (flows through TurkStream remain but are marginal). The aim was to fracture Europe’s political, military and financial support for Ukraine. The result was the most violent price spike in TTF history, which dragged Asian markets higher alongside it.

Since then, Europe has filled the 180bcm void left by Russia with higher LNG imports and lower consumption. What it has not done is replace those lost pipeline volumes — neither through Azerbaijan or North Africa nor through a revival in domestic output. In fact, production has kept falling since 2018, thanks largely to “green” policies in the Netherlands and the UK. Both now produce substantially less natural gas than they did seven years ago. Think of Groningen, once a top-ten global field, shut down because of tremors so minor they’d make every Japanese smile.

Europe, in short, now depends on LNG from across the world to keep its households warm through winter. Were Europe to import the same 68bcm of LNG between October and March as last season, and given today’s relatively mild weather forecasts, storages would fall below 10% — an emergency threshold. Pipeline systems must maintain a minimum pressure to function; below roughly 5%, the system risks mechanical failure.

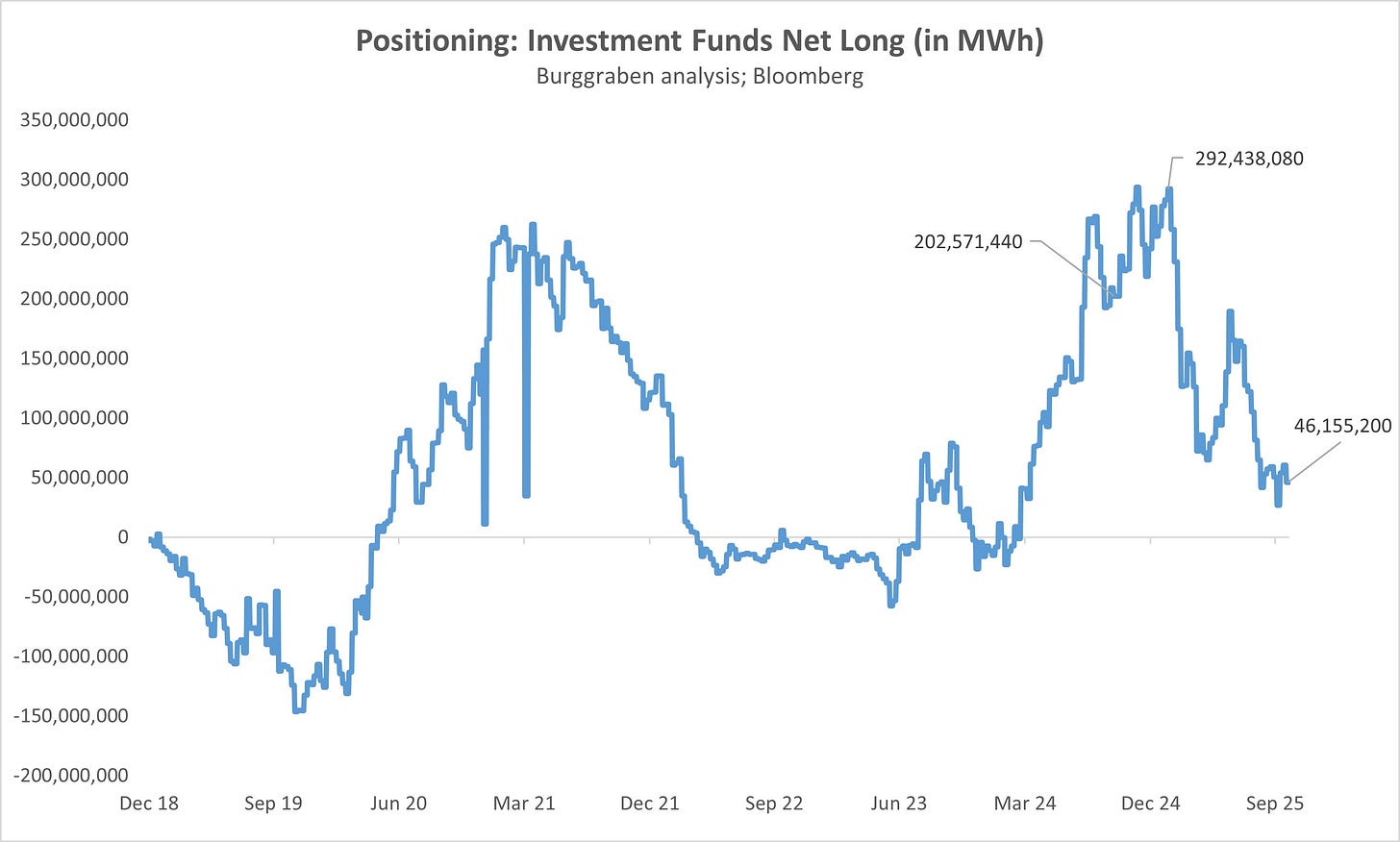

And yet, speculative positioning in TTF — the benchmark European gas contract — has been steadily unwinding. From a February 2025 peak of 292TWh in speculative longs, the market fell to 202TWh around this time last year, when storages were completely full. Now, with storages at only 82%, net speculative longs have collapsed to 46TWh and could turn neutral by November. Who knows.

The Calm Before the Winter Storm?

So why is the market so calm?

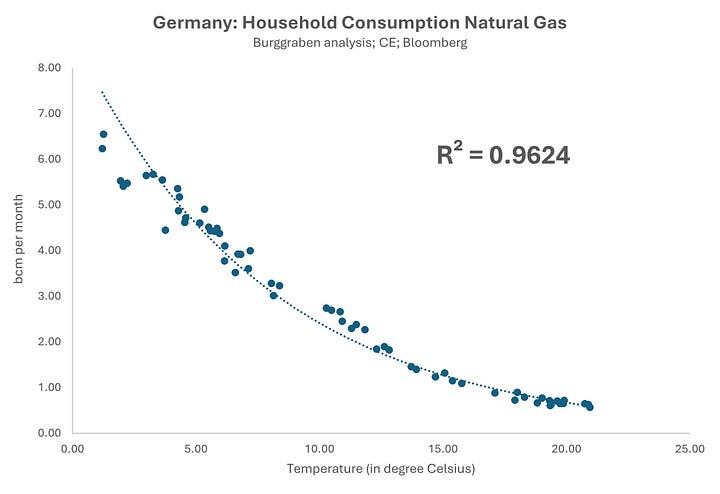

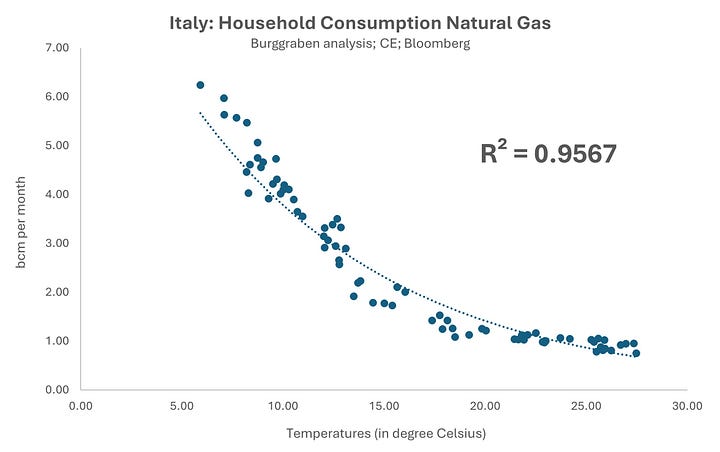

Some may argue, intuitively, that Europe is sliding into a technical recession and that industrial demand for gas and power will be weak this winter. But the recession is likely already here nor is it particularly relevant. What drives European gas consumption are households, not industry or power generation. And some 237 million European households — including those in the UK, Switzerland and Norway — will inevitably turn up the heating as temperatures fall.

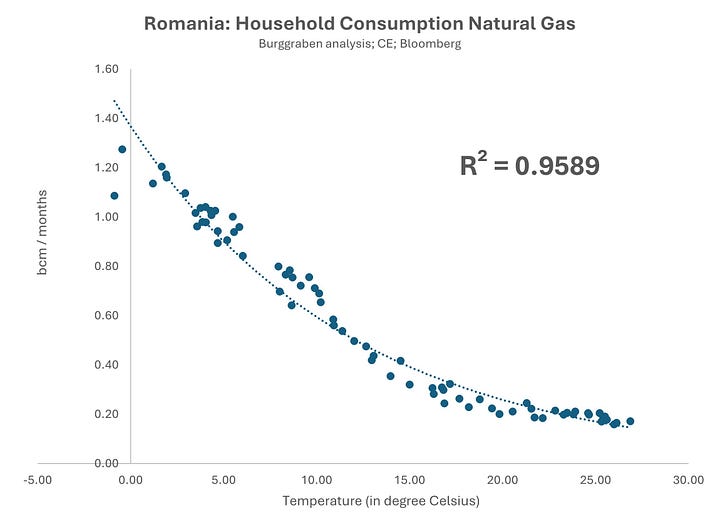

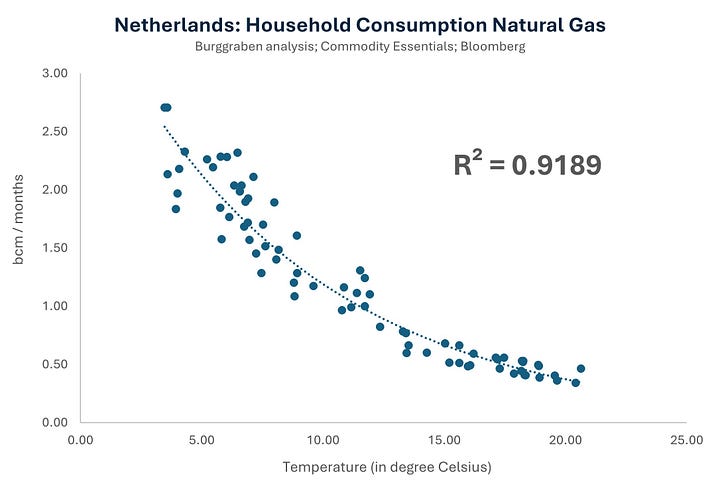

The correlation is stunningly clear, as we’ve shown time and again. From Edinburgh to Rome, from Amsterdam to Bucharest, consumption rises as temperatures drop below 20 °C, and it accelerates exponentially once we fall below 10 °C. Green transition rhetoric aside, the numbers speak for themselves, month after month since 2019. For those of us who care about data, it’s deeply satisfying.

Because of these correlations, we can now forecast European gas demand with remarkable precision. The method is straightforward: country-by-country consumption models built on four independent European weather forecasts, weighted by their certainty. To this, we add industrial demand (adjusted for economic indicators) and power-sector gas use (adjusted for spark spreads and other electricity metrics). The more we refine it, the more accurate and responsive the model becomes — perhaps even a step towards automated trading execution one day.

We’ll see.