Nuclear Weapons Pass ESG Test as War Redefines Ethical Investing

Following up on my article yesterday— on why high expectations so often lead to disillusionment, and what that means for nuclear peace and global security, or what I described as a potential “Versailles Moment” for nuclear proliferation — I thought I’d share this piece published today by Bloomberg. No further comment needed.

Article: By Frances Schwartzkopff, Natasha White and Claudia Cohen; 08/24/2025 23:00:23 [BN]

The deadliest weapons ever manufactured are becoming a regular feature of Europe’s nearly $9 trillion ESG fund industry, as a label long associated with ethical investing gets stretched to accommodate the geopolitical moment.

Since Russia’s full-scale invasion of Ukraine in February 2022, the number of ESG equity funds exposed to the nuclear arms industry has soared more than 50% to over 2,000. Though the holdings represent just a fraction of the wider defense sector, the shift means that roughly half the ESG-registered equity funds in Europe are now allocating at least some capital to companies that manufacture, supply or transport nuclear arms, according to data compiled by Bloomberg.

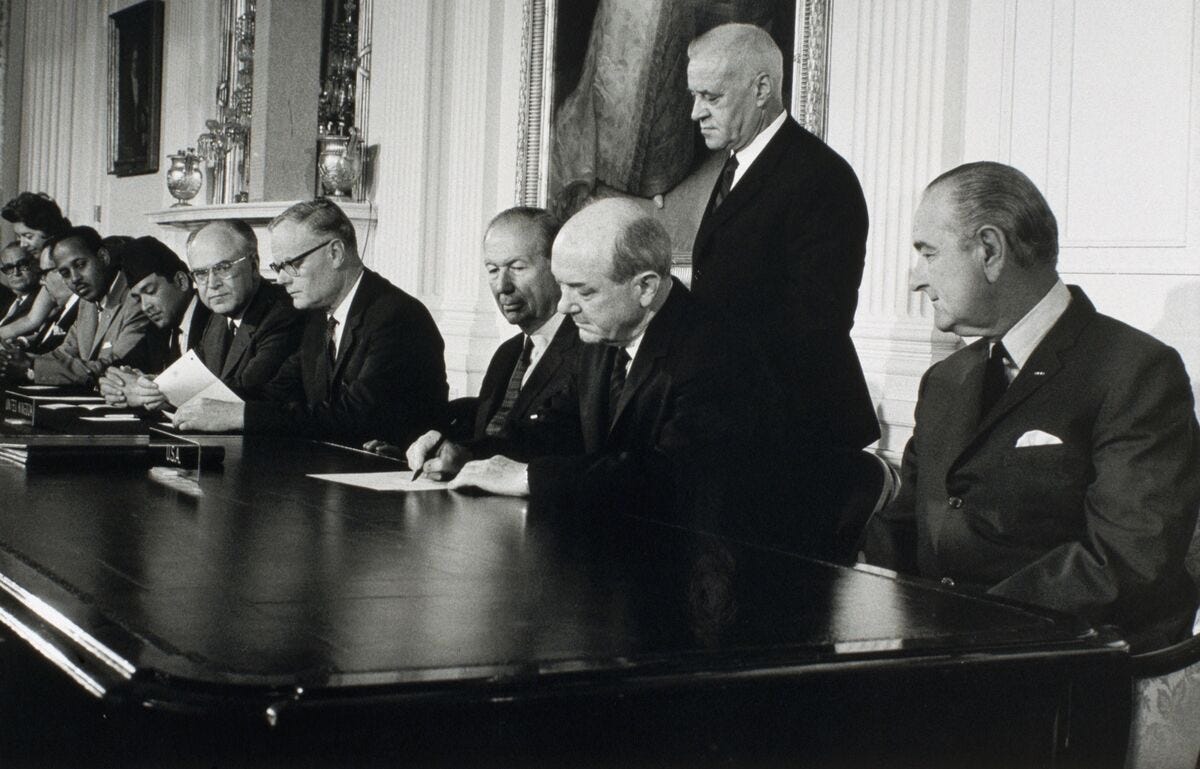

The development puts in the starkest possible terms the dramatic evolution of environmental, social and governance investing practices since the term was coined over two decades ago by a team backed by the United Nations. And as Europe’s tensions with Russia escalate, the idea of what ESG can represent has gone from wind farms to weapons of mass destruction with breathtaking ease.

Some characterize this moment as the ultimate perversion of ESG. A sustainable investment is supposed to be about doing “no harm,” says Sasja Beslik, chief investment strategy officer at SDG Impact Japan, an investment firm based in the first country to feel the full force of a nuclear attack 80 years ago. “And, you know, I think that the ultimate use of nuclear weapons will do a lot of harm.”

Others say that ESG money needs to be channeled toward defending economic and social stability. Matt Christensen, global head of sustainable and impact investing at Allianz Global Investors, says that’s why the $650 billion asset manager will this year start holding nuclear arms manufacturers in funds registered as “promoting” ESG.

With war raging in their backyard, Europe’s leaders have made it clear they don’t want any ESG qualms to get in the way of steering private capital into a military deterrent strong enough to resist Russia. It’s a concept that’s been neatly captured by the chief executive officer of exchange operator Euronext NV.

“In the new ESG, we’re talking about contributing to society by strengthening Europe’s energy autonomy and defense: energy, security and geostrategy,” says Euronext CEO Stephane Boujnah. “We’ve seen a strong collective preference emerge in recent months” from civil society, investors and Euronext’s own employees, he said. “There is an appetite among citizens to serve their country in their own way.”

Euronext says it has no specific “doctrine” regarding nuclear weapons, beyond following European markets regulations.