Maduro is Gone. Is that Good News? Not if you are long oil.

It's path dependent, but it should become a blessing for peace and humanity

Let me give you a quick take on the events unfolding in Venezuela. Given oil is part of my circle of competence, as most of you know well, I will keep this short, sharp, and open (no paywall) for all to read. If you enjoy my take, please re-post it.

Dictator Nicolás Maduro, the bus-driver-turned-dictator, is responsible for the deaths of tens of thousands, the exile of 8 million, and the oppression of 34 million people. All of that was primarily enabled by oil riches, corruption, and the “warmth of collectivism”. Yes, the resource curse is real and alive.

Today, the U.S. administration announced his capture in a special military operation. Maduro and his wife were reportedly flown out of Caracas and are now in U.S. custody at an undisclosed location, with the stated intent to prosecute him in New York on narco-terrorism and drug-trafficking charges. AP News+1

So what is next? We do not know. But if Trump decides to reclaim expropriated U.S. oil assets in Venezuela, perhaps even to govern the country temporarily until institutions are re-established, I am all for it. You should be too, if you dare to think it through to the end.

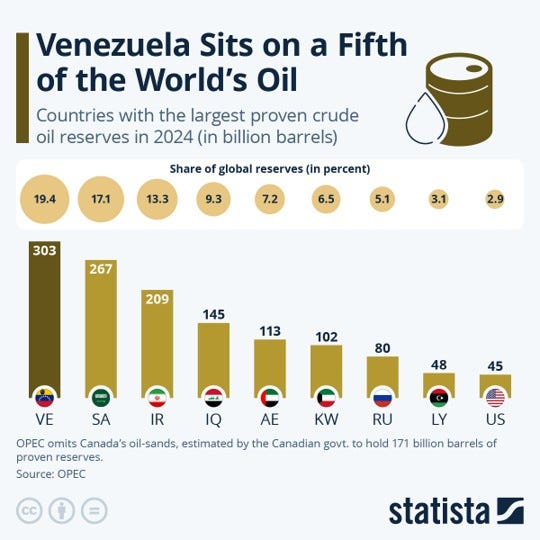

Not only have Venezuelan elites proven incapable of overcoming the resource curse for decades, such a policy would be a blessing for humanity and for freedom. How so? Well, Venezuela is not just another marginal OPEC producer and as one may assume when studying my below OPEC output table over time.

Rather, Venezuela possesses the largest oil reserves globally, with the same conventional qualities as Saudi Arabia does. In other words, it has the potential to influence global oil prices much in the same way as Saudi Arabia does. And as a general rule of thumb, lower oil prices (which is what Trump wants) are a blessing for peace and prosperity.

Before drilling further into geology and barrels, let’s be honest about first principles. In my humble opinion, and I am Swiss, not an American voter, Trump is right when he says U.S. oil assets should be returned to their rightful American ownership. That is clearly his viewpoint. So yes, this intervention is also about oil, not just drugs, and that is exactly where I stand.

As a resource investor, I am sick and tired of watching Western assets get seized by dictators and regimes around the world without just compensation, while Western leaders either look away or hide behind process and polite statements. Let’s not reward corrupt leaders, not now and not ever. Let’s enforce the rule of law wherever Western companies are affected. And even if you disagree with me here (which is totally fine), consider it a blessing as a resource investor as Trump may just have lowered global above-ground risks in emerging markets for all commodities, at least for a while.

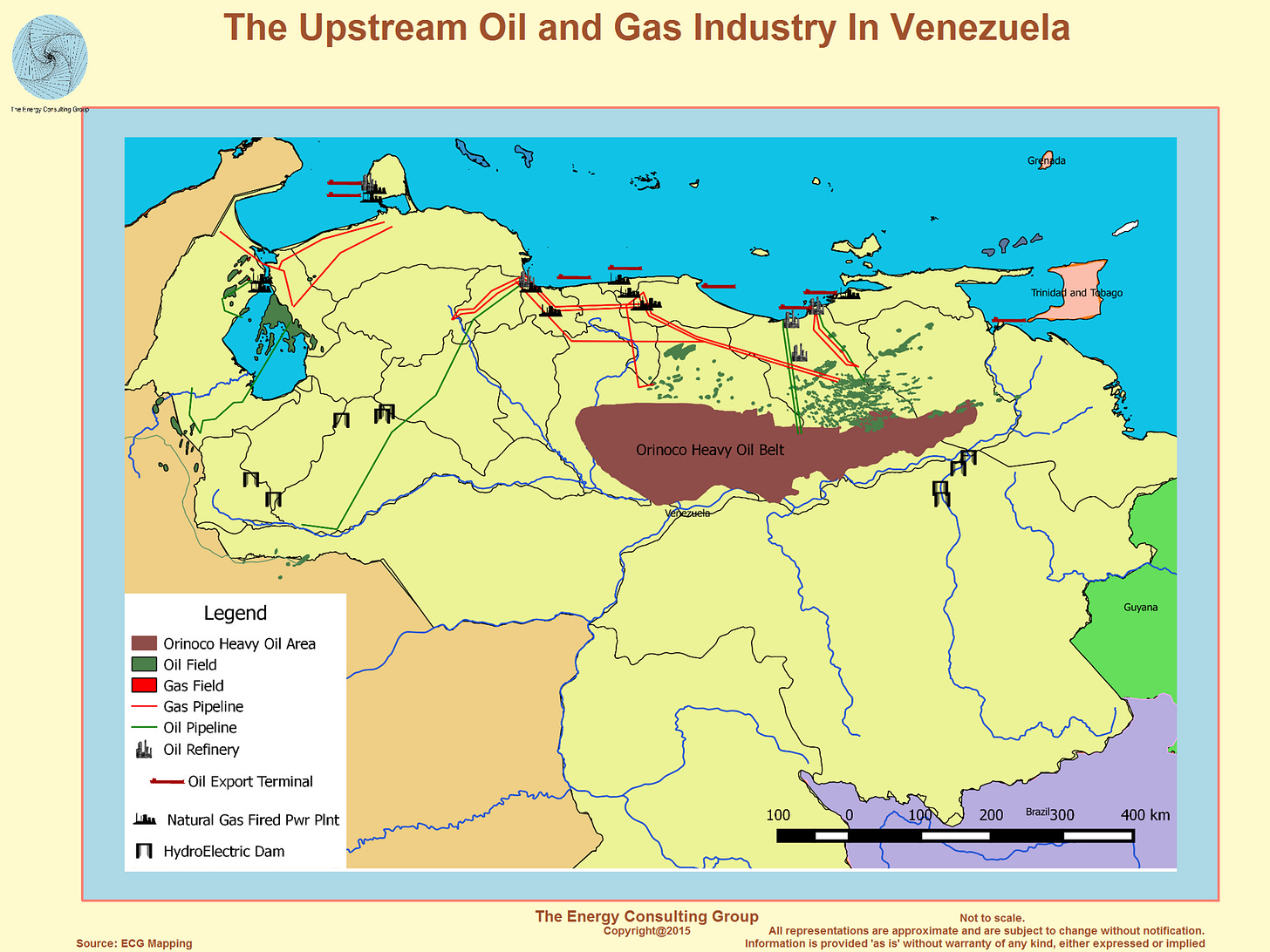

Anyway, Venezuela holds the largest oil reserves in the world, much of which once belonged to Western companies who discovered these reserves and developed some of them, thereby paying their just taxes to the country who hosted them.

The Orinoco Belt alone represents the largest oil accumulation on the planet, with an estimated mean of roughly 513 billion barrels of technically recoverable heavy oil. As for reserves, meaning the portion that is economically proven to be recoverable, Venezuela sits on roughly 20% of all known reserves globally, while its oil output on a total market of roughly 85 million barrels per day (not mix it with total liquids output of some 103 million barrels per day) is about 1%. That’s what socialism and corruption do, lades and gentlemen. Under Maduro, people literally died on the street from hunger, for years. Keep that in mind when the next person pitches us the “warmth of collectivism”.

Note: keep in mind that OPEC oil reserves have an incentive to be overstated as it dicates their production quote which is why, for example, every serious geologist will tell you that, as one example, Kuwait’s heavy oil reserves are overstated. But that is unlikely the case for Venezuela’s heavy oil resource, if you study the USGS report carefully. And even if medicore viscosity halves the ultimate recovery in the Orinoco belt, other resource will mostly likely be found elsewhere, including offshore Venezuela (think Guyana). So the pize is big one way or another and allows for substantial production growth over time.

If the American oil industry and the global oil services industry are allowed to lift that prize, Venezuela will outproduce Saudi Arabia in the next decade. Mark it. I told you now. These fields are so conventional, so prolific, that once the sophistication of today’s oil industry gets unleashed on these reserves, the upside cannot be overstated. American entrepreneurship managed to squeeze 9.8 million barrels per day out of tight hard rock called shale. This is like a swimming pool the size of Texas full of oil to be lifted, piped, and transported. The last frontier of oil riches.

Oil production growth would be a blessing for Venezuela across the board: huge tax income, highly paid jobs, and a surge of associated services, from oil services to construction, from leisure and hotels to restaurants, the whole ecosystem. Think Texas, but much bigger. The left will spin it as colonialism. But as Texas and Norway illustrate, it is called capitalism, and it works with institutions, but never with corrupt elites in emerging markets without functioning institutions. Fact. Quote me, anytime, anywhere.

Under the right conditions, Venezuela’s oil output can scale fast, and even “smaller” growth numbers matter in a commodity market where prices are set at the margin.

Start at roughly 900kbpd today. Fix property rights and the rules of the game, and 1.5mbpd within 18 months is a realistic first milestone. That would be led by the majors with the most knowledge, the deepest balance sheets, and the biggest unresolved claims, Chevron, ConocoPhillips, Exxon, and potentially Shell and ENI. All burned in the past. All sitting on substantial open invoices they will want to recover. ConocoPhillips alone reportedly has an incentive to collect more than US$10bn it is still owed. But let’s be clear, ex Chevron, it is highly unlikely the majors will lean in until there is political stability, clarity on who actually runs the country, and a rock-solid legal framework that cannot be reversed on a whim.

Clear the bottlenecks in pipelines, power, upgrading, and ports, and getting back to 3.5mbpd becomes achievable. Here is where big numbers can be deceptive. Assume it takes US$60bn to get pipes, power, and export infrastructure back into proper shape. That sounds huge until you remember that in 2010, the U.S. shale industry collectively spent more than that on wells alone. Capital exists. Capacity exists. What determines speed is the legal framework. Without it, nothing much changes.

And if the rules get rewritten after Trump, or if Venezuela simply morphs from one corrupt mess into the next, then output gets stuck in the 1.5–3.0mbpd range, at best. That is the downside case. But if the rule of law actually holds, an upside case of 10mbpd over the next decade is not fantasy. It is simply what happens when world-class resources are finally developed by a world-class industry.

And here is the key point: it does not need the upside case to structurally lower prices at the pump, globally. If Venezuela simply becomes a consistent 5mbpd producer, think Canada today, and can hold that level for decades, it would at the very least offset future losses from the U.S. shale industry as its fields mature and decline. In a market where the marginal barrel sets the price, that is enormous.

In fact, you do not even need to wait for 5mbpd. The mere trajectory, Venezuela moving from 0.9mbpd to 1.5mbpd next year, is enough to hurt Brent, because the market is already swimming in supply for 2026 and 2027. Yes, physical commodities price in the present and do not discount the future. But in oil, where paper barrels trade in multiples of the physical market, expectations move prices long before the barrels arrive. Trump’s explicit, determined language can set up paper shorts and push the curve lower well ahead of any meaningful Venezuelan supply hitting the water. Think Q4 2018, when he effectively helped drive Brent from US$90 to US$55 on next to nothing other than an Iran waiver and a change in tone.

Either way, lower-for-longer oil prices would be a blessing for humanity.

Let me qualify my statement above and shut down future critics of my forecast straight away. After all, it is the job of consultants like Energy Aspects to make it sound complicated.

First, and not humble for a change, I have directly and indirectly invested in the oil industry for two decades. I have been on more oil fields in the middle of nowhere than most of the industry’s armchair experts combined. I have won and lost my own money, not other people’s money.

I have spent hundreds of hours analysing this market from the ground up, well by well, country by country, and barrel by barrel at the global level. I have used pretty much every serious data tool out there, from Kpler to OilX, Kayrros, JODI, and the major agency services. For a while, I genuinely think I knew where each barrel was flowing in close to real time. So have a bit of faith when I shortcut the exercise here.

Second, of course, I do not know the future output number, by definition. This is not a physics problem. It is path dependent, meaning it depends entirely on what happens next. If Trump does not follow through, if property rights are not fixed, if Venezuela simply goes from one corrupt mess to the next after Maduro’s removal, then nothing changes, or it changes only at the margin. But if Trump does the job half right, then Venezuela will be bigger than the plot, believe me. These wells will become monsters, and the industry will be capable of developing them in record time, provided politics is kept at bay.

The latter, however, must be established. The starting point for oil output growth is property rights, the rule of law & free market enterprise. Without that, expect little growth despite prolific oil reserves. Perhaps 1.5mbpd by year-end 2027? Who knows.

Third, and this is the bit most people miss, Venezuela is not starting from zero. Venezuela is what the industry calls a “brownfield”. Chevron is already producing roughly 300,000 barrels per day in Venezuela right now. They got a licence during the Biden administration and have been in the country for nearly 100 years. That means Chevron has decades of geological data, production history, and operational knowledge. ConocoPhilipps and Exxon left in 2007, after decades of production and when then-President Hugo Chávez forcefully renegotiated contracts with all majors, including European ones. The takeaway here is that the majors already know where the oil is, what works, what breaks, and how to scale. They probably have better data than PDVSA itself. That is a huge head start for any comeback.

This is why Venezuela will not look like the Soviet Union, where Western firms were blocked by politics and had to learn everything from scratch. Oil is not just pipes and pumps. It is logistics, engineering, process discipline, and a mountain of data. Once you have the knowledge, and once the rules of the game are fixed, the capital and the capability follow.

Anyway, there remain huge “ifs”. But even a middle outcome, say 4–5mbpd, will change global liquid balances in a structural way. It will be brutal, believe me, because Venezuela will produce some of the cheapest oil on the planet. It will change a lot. Let’s hope it will happen.

Again, and given many of you will find it hard to see how Venezuela could grow its oil output meaningfully and once property rights and the rule of law are re-established, let me offer another perspective.

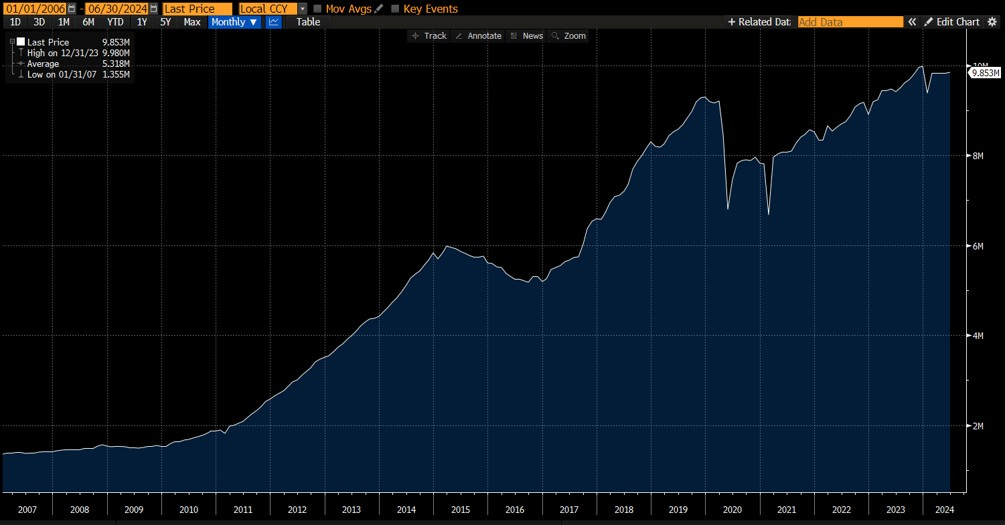

America pulled off something that, at the time, looked equally absurd. U.S. shale oil output grew from 1.8mbpd in 2010 to 9.8mbpd by the end of 2025. In other words, American entrepreneurship built an entire Saudi Arabia’s worth of oil production out of rock. If you include Alaska and the Gulf of Mexico, the U.S. now produces roughly 13.8mbpd in total, which is a different universe from what most people thought was possible 15 years ago.

So what? Here is the point: shale is brutally hard compared with conventional onshore oil. It is not sitting in a friendly underground “tank” of limestone or sandstone where it naturally wants to flow. Shale is trapped in tight source rock, with miserably low porosity and permeability, meaning the oil basically does not want to move. You do not “drill a well” and let it produce. You assault the rock with horizontal drilling, multi-stage fracturing, enormous volumes of equipment, people, water, sand, steel, and capital, just to release small packets of oil at a time. Think hundreds of thousands of barrels per well, not the millions and tens of millions conventional reservoirs can deliver and for years, not a few months like shale and then you have to drill the next hole (which the industry calls the Drilling Frenzy).

That is why the shale revolution is one of the great industrial feats of our time. It was not just a story of geology. It was a story of incentives, property rights, technology, logistics, and capital markets all aligning at once.

Now compare that with Venezuela, and specifically the Orinoco. Whatever you think about heavy oil, and yes, it comes with upgrading and processing challenges, from a pure “can we get the molecules out of the ground” perspective, Orinoco heavies are light years easier to get out of the ground when compared to shale.

A quick look at the slide above gives you a numerical perspective. Shale permeability sits in the 0.001 to 0.1 millidarcy range. The heavy oil reservoirs in Venezuela’s Orinoco Belt typically range from 1,000 to north of 13,000 millidarcies. That is not a rounding error. That is several orders of magnitude. Same story with porosity. Permian shale, the best shale on the planet, typically runs 4–8%. Orinoco heavy oil sands are more like 20–38%. So ask yourself a simple question. Which resource would you rather drill and produce, if politics is kept out of the way? And which one do you think produces lower full-cycle breakevens?

Yes, the U.S. had three massive tailwinds that made shale scale fast. First, property rights. In places like Texas, the landowner typically owns the minerals under their land, which creates a direct incentive to develop it. Second, the oil services ecosystem. Texas has an enormous, decentralised oil services industry that can mobilise quickly and compete aggressively. Third, financing. The U.S. has the deepest debt and equity markets in the world, which allowed shale to be funded at scale, even when it looked crazy to outsiders. Add those together and you get speed.

But here is the punchline: even with all those tailwinds, shale was still a technical nightmare compared with conventional onshore resources in the Orinoco Belt. If American capitalism can manufacture a Saudi Arabia out of tight rock in 15 years, then once Venezuela has functioning property rights and basic rule of law, the global oil and gas industry will rush in and treat the Orinoco for what it is, the last great frontier of oil riches. Because it actually is.

Now, does Trump accept the political risk of nation-building in this case? The answer is yes. That is, in fact, his stated goal, and he says it as plainly as a President ever does. Listen to him yourself.

Trump’s administration will not leave quickly. They want the oil assets back, they want to rebuild the industry, and they want to get paid for past expropriation and losses. That is the strategy, in black and white.

My point? Be very bearish oil prices. Trump’s message is huge. In fact, it’s a game changer for the oil industry where I sit. And yes, nothing will change overnight. But it will change, every day a little more. You have been warned.

Besides, I do not see the risk for this administration in the way the usual critics will frame it. This is not fighting a war in Afghanistan against a hostile insurgency. It is not trying to transplant institutions into Iran or Afghanistan under an Islamic political order with built-in hostility towards Western values.

This is Venezuela. It is culturally Western, overwhelmingly Christian, and it used to be a beacon of success before the socialists around Hugo Chávez and Nicolás Maduro destroyed it systematically. This is fixable.

Now let’s zoom out. This is not just a Venezuela story. It is a global oil price story, and therefore a geopolitical story. Venezuela has the potential to deliver structurally lower oil prices, or at least prices as low as today, for a long time to come (ceteris paribus). If that happens, it will cut the financial oxygen feeding the war in Ukraine and squeeze the Kremlin’s mobsters, substantially weakening the CCP in the process.

And before all of that, the mullahs could be gone too, reinforcing the chain reaction, because they also sit on massive untouched oil reserves waiting to be lifted by the invisible hand of the rule of law.

All of this will break the cheque books of terrorist sponsors in Qatar and elsewhere. And that, ladies, is a blessing for peace and humanity.

You will not hear any of this from the progressive-left “do-gooder” Marxist cult in the coming weeks. But the fact is that lower oil prices are one of the biggest creators of peace and prosperity. Few ever get that.

Instead, the left will raise every objection, however absurd, until they inevitably find themselves siding with murderers and dictators. Such are the rules of the legacy media game today, sadly. They are strictly partisan.

Of course, the Venezuela episode is far from over, and the final outcome is not written in stone yet. But Trump may well deserve the Nobel Prize if luck, ongoing courage, and good decision-making remain on his side. For now, he is on track where I sit.

Therefore, let us give credit where credit is due. We shall praise and criticise each action on its merits, never by partisan colour. Well done, Donald Trump and team.

And please, do not dare criticise this surgical, highly successful military operation for even one second. Salute it. I do.

Warm regards

Alexander

PS: For good order sake, here is the full press conference of the operation yesterday night and for our archives.

In my mind, what will be most interesting to watch relates to your first caveat of rule of law. Venezuela had rule of law, stability, and significant foreign capital investment. Then the rug was pulled on all of that and the assets were stolen. How long will it take the oil majors to feel comfortable that rule of law has been re-established and will remain so? If I'm sitting in the Boardroom as the company considers a 9 or 10 figure capital investment program in Venezuela somebody will need to convince me that whatever structure is put in place is going to last a decade so I can earn a return on my capital before it gets expropriated again.

Alexander, this is a masterclass in geology. But permit me to offer a different geopolitical vector.

You are absolutely correct on the physics: The Orinoco Belt is indeed a "Liquid Ore" superior to Shale in terms of EROI. As you noted, US Shale was an engineering miracle fighting against geology; Venezuela is simply geology waiting for engineering.

However, from the ChinArb perspective, I see two distinct risks in your "Victory Scenario":

1. The Sovereign Margin Call You frame this as a victory for Rule of Law. I see it as a desperate Physical Hedging by System A. The US refining complex (PADD 3) is structurally short on Heavy Sour crude. It produced too much "Champagne" (Light Sweet Shale) and starved its own "Stomach" (Cokers). Taking Venezuela isn't just about punishing a dictator; it is a Sovereign Margin Call. The US must seize physical assets to backstop its energy security because domestic shale has hit a thermodynamic plateau.

2. The "Cheap Oil" Paradox (The Boomerang) You argue that lower oil prices will "weaken the CCP." This is the fatal miscalculation. System B (China) is the world's largest energy importer. It is a machine designed to convert Energy into Goods. If Trump successfully crashes oil prices to $40/bbl, he is effectively subsidizing the input costs of the entire Chinese manufacturing engine.

Cheaper Oil = Cheaper Logistics for Temu.

Cheaper Oil = Cheaper Petrochemicals for Shein.

Cheaper Oil = A lower break-even point for the R.I.C.E. system.

While low oil hurts Russia/Iran, it supercharges the Chinese deflationary machine that is currently crushing Western industry. Trump might win the Energy War, only to find he has accelerated his defeat in the Industrial War.

Physics is impartial. Low energy prices feed the most efficient converter. We just published a deep dive on this "Two Systems" dynamic (“Venezuela and the Arctic” https://substack.com/@chinarbitrageur/note/p-183349785?utm_source=notes-share-action&r=71ctq6 ). Would love your thoughts on the routing implications.