Content Guidance: Gold Miners Next

What to Expect Next

In natural resources, companies can only move in two directions: they either grow, or they decline as reserves are depleted. Standing still is not an option. Both paths can create wealth — or destroy it — for shareholders.

A disciplined management team can, in theory, extract the last ounce of a great gold, copper, nickel, or oil deposit efficiently and return capital to shareholders without needing to risk reinventing itself. The Lundins have done this successfully, over and over again.

Yet in practice, very few succeed like them. A resource company without a long-term vision is often like a sinking ship: it struggles to attract and retain talent, trades at a discount to NAV, and destroys capital as the asset is undermanaged, underfunded, or both. The slightest hiccup can push costs above breakeven and put the entire asset at risk.

Meanwhile, growth has an even worse track record. From ExxonMobil to Chesapeake in oil & gas, from Glencore to Rio Tinto in base metals, from Barrick to Newmont in gold — history shows a consistent pattern: resource companies are, on average, poor stewards of capital, mediocre operators of assets, and chronic under-estimators of geological and geopolitical risk. The result: declining earnings per share, dwindling reserves per share, and dismal returns on invested capital.

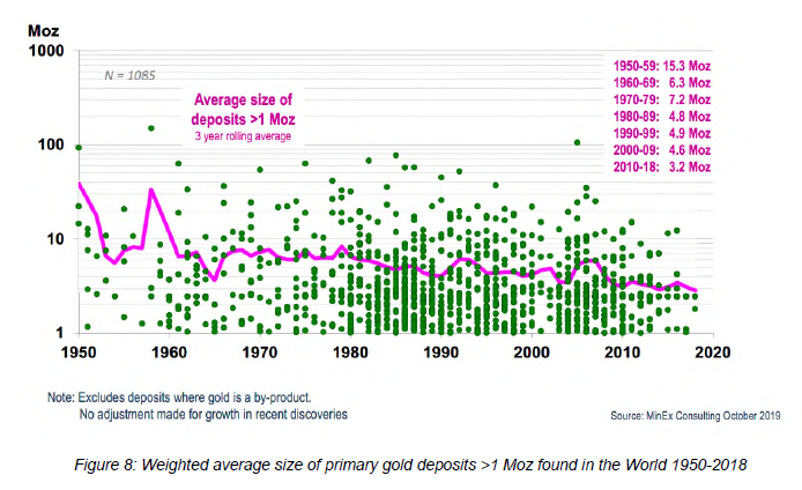

The key problem starts at the beginning of the replacement process: discoveries. Finding a meaningful gold discovery resembles finding the proverbial needle in a haystack. Not only are new discoveries scarce, but they are shrinking in scale. Industry databases show that the average “major” discovery of the past decade (>2 Moz) contains about 3.5 million ounces, down from 5.5 million ounces in the 2010s.

But even this overstates reality, since only deposits above 2 Moz are counted. In practice, most new deposits being advanced today are in the 1–2 Moz range — far too small to replace the 5–10 Moz depletion profiles of the majors and often too small to be durable commercial successes. No discovery from the past 10 years has cracked the list of the world’s 30 largest, underscoring just how rare Tier-1 gold finds have become.

And size matters. A 5 Moz gold deposit can sustain 200–300 koz of annual production over 15+ years, making it bankable, scalable, and attractive to majors. By contrast, a 2 Moz deposit typically supports <100 koz/year over a short mine life. Fixed costs dominate, debt is harder to raise, and the economics are fragile to any hiccup in commodity prices. That is why smaller deposits often end up stranded.

It gets more brutal. One of the great truths in resources is that big deposits often get bigger, while small deposits usually disappoint. History shows that Tier-1 discoveries like Grasberg and Yanacocha grew multiples of their original size as brownfield drilling continued, whereas most 1–2 Moz deposits fail to reach production or underperform if they do.

Rubicon Minerals’ Phoenix project in Ontario is a cautionary tale: once promoted as a 3 Moz high-grade discovery, it consumed ~US$770m of capital, then collapsed when production fell short of forecasts. Industry studies confirm the pattern: fewer than 10% of small discoveries become lasting mines, and those that do rarely replace what majors need. As investors, we must be wary of “promising” small deposits — the odds are stacked against them.

So why bother with natural resources at all? Because cyclical industries, when understood properly, can be the most rewarding of all. A quality asset bought early — or a stake alongside a talented, disciplined steward — can easily return tenfold within a few years.

The evidence of stewardship and long-term value creation is clear: the Lundin family (multi-cycle builders across mining and energy), the Sawiris family office (patient capital behind Endeavour and G Mining), Pierre Lassonde (royalty pioneer at Franco-Nevada), Robert Friedland (copper visionary at Ivanhoe), Rob McEwen (who revolutionized exploration by crowdsourcing Goldcorp’s Red Lake data, unlocking world-class discoveries), Bill Beament (who led Northern Star to a decade of outperformance), Andrew Forrest (who turned Fortescue into an iron-ore giant), Kjell Inge Røkke (who shaped Aker BP into a disciplined oil & gas platform), and Amir Adnani (who built UEC into the leading U.S. uranium producer). Collectively, they prove a simple truth: in resources, leadership and stewardship often matter more than the rock itself.

But not every story ends like the Lundins or Lassonde. For every world-class steward, there are dozens of companies built on hype and hope. Spotting the difference is where investors must be rigorous.

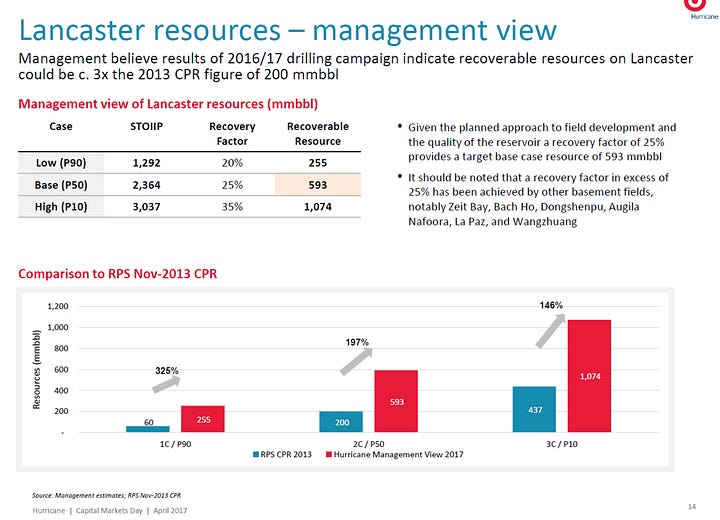

Take Hurricane Energy. In 2017, it was one of the UK’s most hyped oil stories — a “fractured basement” discovery touted as holding 460 million barrels. Backed by reputable investors and praised widely, the narrative was irresistible. We commissioned RS Energy Group in Toronto to study the resource. Ross Runciman, a senior geologist there, returned a 100-page report. His conclusion, boiled down: the deposit was a fluke. That US$50,000 report protected our capital. Within two years, production collapsed and the company failed. The lesson: in resource investing, one must understand the resource itself — and oneself, independently — because reports and teams often don’t, or worse, mislead.

And while going the extra mile takes discipline and hard work, much of this is not rocket science and doesn’t require big capital outlays with independent specialists. It comes down to common-sense curiosity: asking the right questions, checking assumptions, and refusing to take glossy presentations at face value. Anyone willing to be patient and diligent can build the tools to succeed. My goal with this series is to share what we look for — and help you build your own independent framework to spot value and avoid costly mistakes.

In the coming months, I will lay out the DNA of great, mediocre, and poor resource companies: what defines them, why they create enduring value (or don’t), and how to spot them early. We will start with gold miners. Gold, I believe, is in a super-cycle. I prefer to begin where you can convert insight into results immediately, while I remain cautious on the cycle for copper and energy commodities.

But why bother at all if even mediocre miners could benefit from a gold upcycle? Because there is no rule that says they must. So far, poor quality has not benefited, while quality gold companies have performed extremely well over the past 12 months. By the end of this series, I hope you will see clearly why quality almost always outperforms — and feel equipped to separate signal (5%) from noise (95%) for decades to come.

One important rule we must establish upfront to avoid misunderstandings: I will not tell you what to own. Instead, I will explain what makes a mining company high-quality and how we value it. Prices move; strategies change; above- and below-ground risks strike. I cannot update my views monthly. Ultimately, you are the steward of your own capital. My aim is to provide a framework you can apply independently.

For annual subscribers, I’m happy to provide short feedback on gold names you’re considering — as input to, not a substitute for, your own due diligence.

Finally, a word on approach. At Burggraben, we are investors, not traders. That is not a dismissal of trading; it reflects my background in private equity and operations, and the long-run statistics: patient investing, with time as your ally, tends to outperform attempts to time markets. Our promise is to focus on structural insights — at the company and sector level — and to go the extra mile so you can make higher-conviction decisions.

So: in the months ahead, expect deep dives into individual gold miners (likely around ten, across seniors, intermediates, and juniors). In parallel, we’ll address copper, uranium, oil & gas, and the European gas market (TTF) as winter approaches. We’ll also update our work on China and offer context on geopolitical shifts such as the war in Ukraine — because what Russia does still matters for commodities.

Warm regards,

Alexander Stahel

PS: Which Senior gold miner would you like me to discuss first and why for the above excel list? Please send us a message.

Curious to learn about your framework as i am keen to stress test my personal gold longs: EQX, ARTG, KNT, GOT

Start with AEM, LUG and GMIN