China's Paradox under Xi - Episode 3 of 7

A Sea /xi:/of Macro Imbalances -a Story Told Through the Lens of its Bust Property Bubble. Episode 3: Importance of Land Sales for Local Governments

Let us continue our journey on China, shall we?

In this episode, we will discuss the Chinese tax system, local government revenues and the importance of land concession sales to balance their budgets. We will explain that Chinese households and local governments are already in what Richard Koo calls a “balance sheet recession”. This is a key puzzle to appreciate the CCP’s inner workings and the sea of macro economic imbalances that the country faces.

Before we continue, let us briefly recap the property picture as explained in the past two episodes here and here:

China’s real estate sector is absolutely massive and analyzing it offers the best insight into the Chinese economic growth model. It represents 25% of the Chinese economy, 70% of Chinese household wealth and 10% of Chinese employment.

But today, China’s real estate sector faces huge challenges: the equivalent of one and a half Japan standing vacant, one Netherlands available for sale and nearly one United States to be completed but not funded which remains full recourse to home buyers who already paid the full purchase price up front.

However, perhaps the most concerning aspect of the collapsing real estate market is the fact that land concession sales (for housing) accounted for 36% of local government revenues. Let’s look at this now.

Tax Sharing System

Chinese home buyers aren’t the only ones hurting. Local governments are in pain, too. To fully understand that we must briefly look at China’s unitary state with its so called “Tax Sharing System”.

Its most important feature is that the central government determines the types and rates of all taxes. Practically speaking, local governments have no tax autonomy. We highlighted the five main property-related taxes that are locally collected in green below.

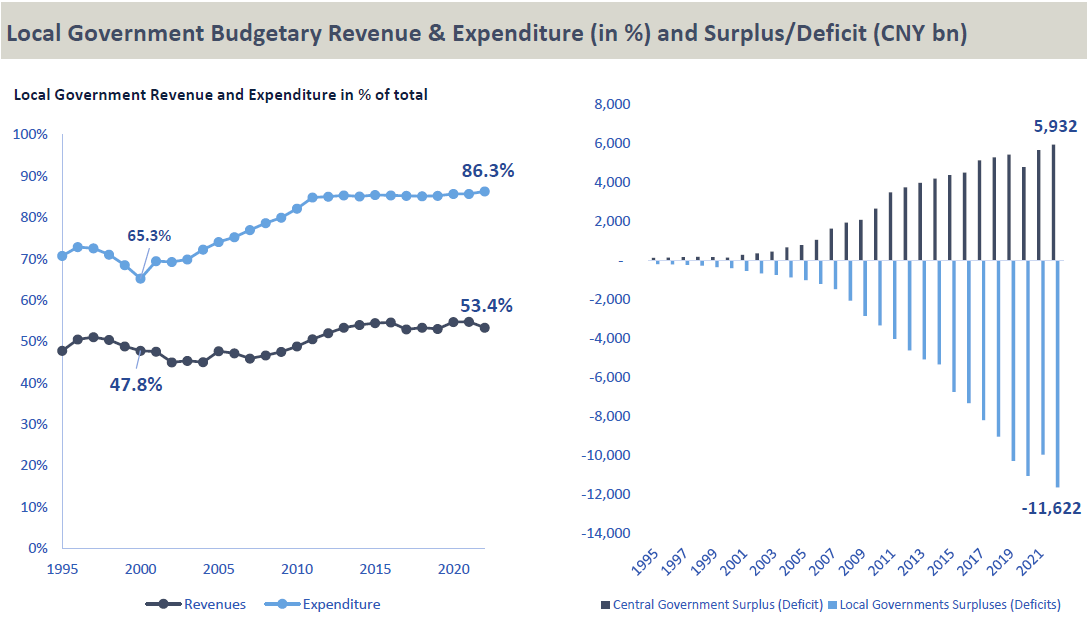

Since the establishment of the tax-sharing system in 1994, local governments’ share of budgetary revenues has been around 45-53%.

However, public budgetary expenditures are highly decentralized which means that local governments carry most of the burden despite only collecting about half of the budgetary revenues.

In order to close some of that budgetary gap, local governments created so called “Extra-Budgetary Revenues”. The 1994 reforms permitted local governments to engage in land financing, where they would earn revenue through leasing land.

In addition, the reforms saw the central government give up its share of land transfer proceeds, so the proceeds would belong entirely to local governments. This incentivized local governments to increase land value by developing infrastructure.

However, the 1994 reform also mandated that local governments must have balanced budgets and zero debt, which made it harder for them to secure financing for infrastructure development. Neither were local governments permitted to issue debt to finance infrastructure projects until 2014.

So called Local Government Financing Vehicles (LGFV) emerged as a solution to the problem of raising finance for these projects. LGFVs borrow money from creditors, mostly by selling bonds in security markets. LGFVs then provide funding to comprehensive urban development projects. The developments typically increase the value of the surrounding land, which is owned by the local government.

The higher land value then boosts local government revenue, through the local government's leasing of land by selling land use-rights (or land concession sales or land sales). This model worked beautifully while cities had rural to urban migration, companies created new jobs and prices of everything went up.

In fact, between 2013 and 2022, land concession sales alone made up 36% of total local government revenues. Adding property related taxes means that 48% of local government revenues relate to real estate activity.

So forget the “25% of GDP is Real Estate-related” number! The most important number a booming property sector delivered was the 36% revenue income to local governments.

This entire local government financing system relied on a constant flow of land sales and began to unravel as the real estate sector tumbled in 2021. Then, land concession sales by local governments eroded steadily and have reached a new low in August 2024 with a collapse of minus 41.8% year on year.

While the full year 2023 tax revenue number wasn’t published by the NBS at the time of publishing this episode we know that land concession sales, which are reported monthly by the Ministry of Finance, are CNY 5,800 billion for 2023 or 11% lower year-over-year.

Even more interesting, December land sales alone were CNY 1,600 billion or 33% of the 2023 number. Have LGFVs degenerated to balance the local government budgets at year-end and what are the underlying projects?

Of course, you guessed correctly. LGFV weren’t just used to support growth by spearheading infrastructure investment. Instead, for years, the financing vehicles were called upon to prop up strained government finances too.