Alamos Gold — A Picasso That Gets Better with Age

How Land Optionality and Discipline Compound Value in Gold Mining

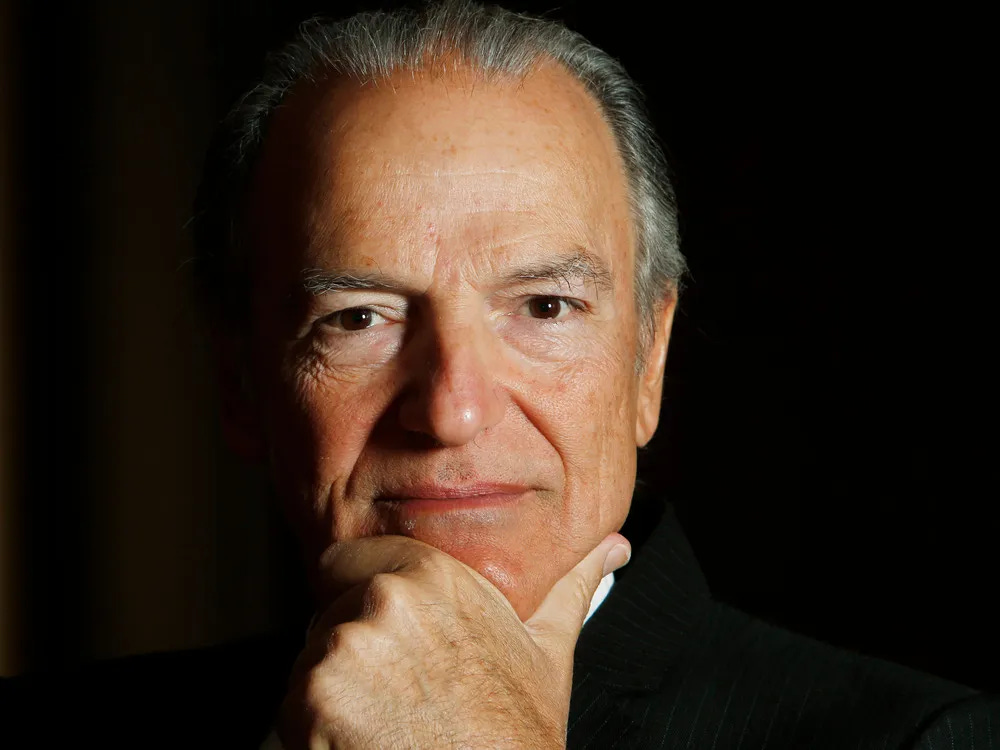

“It’s the optionality value of the land, the value of the operator spending money on our land, and the optionality to higher gold prices. And that is worth so much money… it’s what’s given us the Goldstrike billion-dollar royalty, the Detour billion-dollar royalty, the Tasiast royalty, and so on.”

Pierre Lassonde, Founder Franco Nevada

Guiding Principle

Last month I promised a series of gold-miner drill-downs. This is the first, and it will set the tone for the rest. My aim is simple and unfashionable: help you look under the roof of resource companies the way we have done for more than 10 years. This is not trading. It is fundamental work anchored in an industrial view of how mines actually make money, tied to a Discounted Cash Flow that treats the business as if you owned 100% of it. Gold will remain volatile, yet the metal sits in a structural bull I intend to lay out in detail this year. For now, we begin where it matters: the miners.

I’ll start with Alamos Gold because it lets us teach the discipline of underground mining through a live, compounding case: Island District, Young-Davidson, Mulatos pivoting underground, and Lynn Lake moving from permit to construction. You will learn how geology, method, power, people, and capital combine in the only way that counts—cash flow. You will also see why words like “resource,” “reserve,” “cutoff,” “AISC,” and “optionality” are not jargon; they are the grammar of value.

Thereafter and as a preview, this series will continue with Lundin Gold, then K92 Mining and Osisko Development. Each of these underground operations or soon-to-be operations sit at a different point in the life cycle, in a different jurisdiction, with different ore bodies and methods—long-hole stoping versus bulk tonnage, shaft versus ramp, grid power versus diesel.

Those choices explain costs, margins, replacement ratios, and the pace of discovery. They also let us talk plainly about capital structure: royalties, streams, prepay gold loans, and why taxes—royalties, VAT, withholding, windfalls—are not a footnote but a central driver of intrinsic value. Country risk will be treated the same way: not sentiment, but contracts, cash costs, power tariffs, permits, and social license.

Later in the series we’ll move to open-pit gold miners and heap-leach operators, because understanding how oxide flowsheets print cash at scale is as important as knowing how a shaft mine compounds.

If you stay with me through this arc, you won’t need to chase tickers or narratives. You’ll have the tools to read a technical report, translate it into cash, and decide whether time is your friend or your enemy.

That, in the end, is the point of this Substack. Let’s begin…

Alamos Gold and the Value of Land Optionality

Pierre Lassonde bought Franco-Nevada’s first royalty in 1986 on the Goldstrike mine in Nevada’s Carlin Trend for US$2m. At the time it was a small heap-leach run by Western States Mining.

Soon after, American Barrick (now Barrick) bought Goldstrike and drilled deep. The result was a 50Moz system that powered Barrick—and turned Franco-Nevada’s tiny cheque into a franchise.

That is land optionality: let a capable operator spend money on your ground, let geology and time do their work, and let higher gold prices widen the funnel.

John McCluskey at Alamos has done the same in his own way. Few outside the industry realize he’s a living legend—active, disciplined, and still compounding.

If you want a clean, liquid way to be long gold with operating leverage, Alamos Gold is, in my view, the best beta in the space that still trades easily.

Why is Alamos special? It starts—and ends—with people.